Marvell Technology Soars: Why AI Spending is Fueling This Semiconductor Stock's Rise

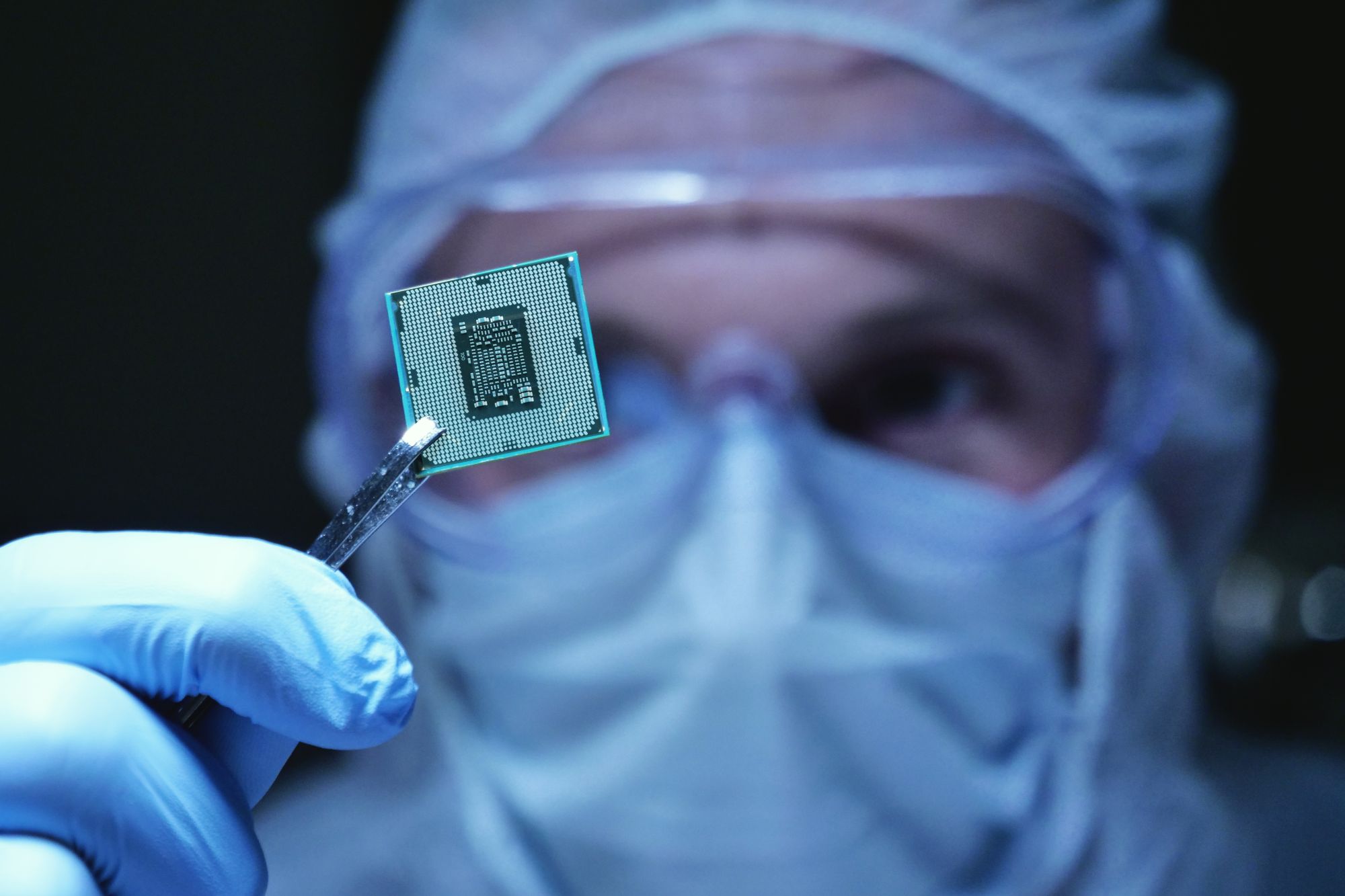

Marvell Technology (MRVL) has been experiencing a significant surge in its stock price recently, and for good reason. The company, a key player in the semiconductor industry, is strategically positioned to benefit from the explosive growth of artificial intelligence (AI). This isn't just a fleeting trend; it's a sustained investment wave that’s reshaping the technology landscape, and Marvell is riding that wave.

The AI Boom: A Tailwind for Marvell

The current surge in AI adoption across various sectors – from cloud computing and data centres to automotive and edge computing – is driving unprecedented demand for specialized hardware. AI models, particularly large language models (LLMs), require immense computational power and vast amounts of data processing capabilities. This translates directly into increased demand for the chips and infrastructure that power these systems.

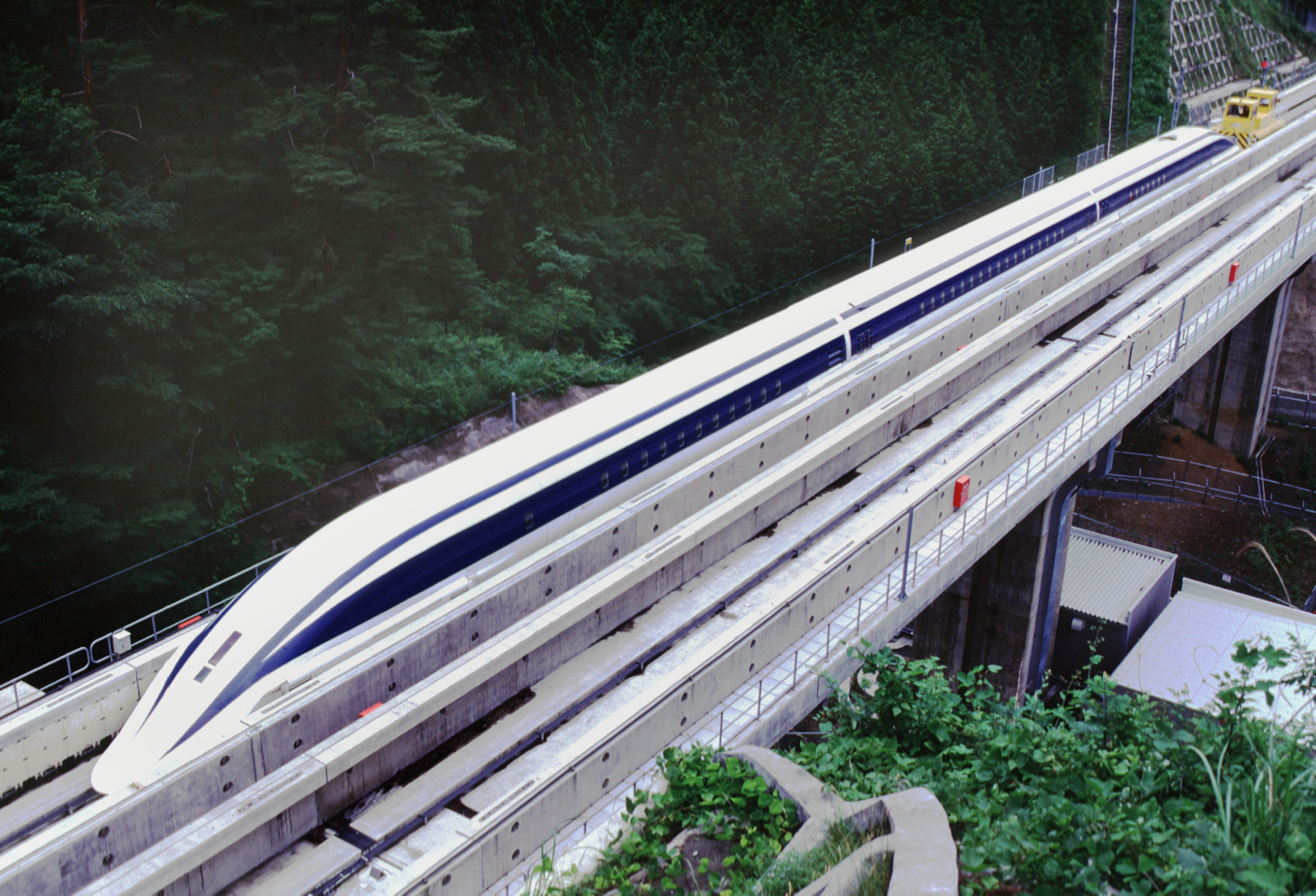

Marvell specializes in providing the critical 'connect' components – chips that enable data to move quickly and efficiently between different parts of a system. Think of them as the highways of the digital world. As AI workloads grow, so does the need for high-bandwidth, low-latency interconnect solutions, precisely where Marvell excels.

Beyond AI: Diversification and Strategic Acquisitions

While AI is undoubtedly a major catalyst, Marvell’s recent success isn't solely attributable to this trend. The company has strategically diversified its product portfolio and expanded its reach through key acquisitions. Their focus on data infrastructure, including 5G networks, data centres, and cloud computing, provides a broader foundation for growth.

The acquisition of Innovium, for instance, significantly bolstered Marvell's position in the data processing unit (DPU) market. DPUs are becoming increasingly essential in modern data centres, offloading tasks from CPUs and enabling more efficient data handling. This acquisition demonstrates Marvell’s commitment to providing comprehensive solutions for the evolving data infrastructure needs.

Financial Performance and Analyst Sentiment

Marvell’s recent financial results have been encouraging, with strong revenue growth and improved profit margins. The company has consistently exceeded analysts' expectations, further fueling investor confidence. Analysts are generally optimistic about Marvell’s future prospects, citing its strong market position, innovative product pipeline, and exposure to high-growth markets.

Potential Risks and Challenges

Despite the positive outlook, it's important to acknowledge potential risks. The semiconductor industry is cyclical and susceptible to economic downturns. Geopolitical tensions and supply chain disruptions could also impact Marvell’s operations. Furthermore, increased competition from other chip manufacturers remains a constant challenge.

The Bottom Line: A Compelling Investment Opportunity?

Marvell Technology’s recent stock surge is underpinned by a powerful combination of factors: the booming AI market, strategic diversification, successful acquisitions, and strong financial performance. While risks exist, the company’s positioning within the high-growth data infrastructure and AI space makes it a compelling investment opportunity for those seeking exposure to the future of technology. Investors should carefully consider their own risk tolerance and conduct thorough research before making any investment decisions.