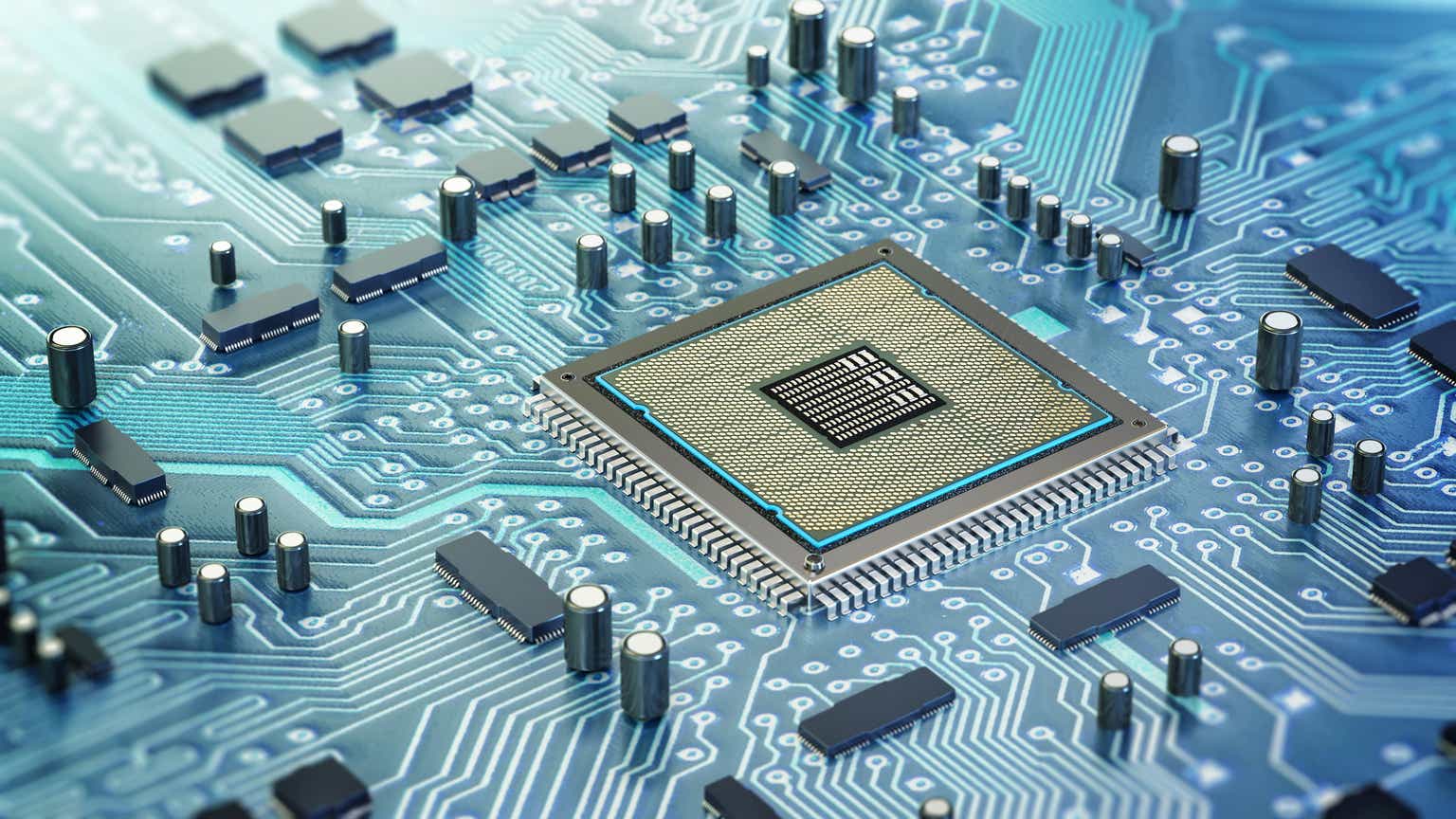

MACOM: Riding a Growth Wave, But Is the Price Right? A Hold Recommendation

MACOM Technology Solutions (MTSI) has been generating considerable buzz in the semiconductor industry, and for good reason. The company, a leading provider of high-frequency integrated circuits and components, has consistently demonstrated impressive revenue growth, driven by strong demand in key sectors like 5G infrastructure, aerospace & defense, and industrial applications. However, a closer look reveals a more nuanced picture – one where a premium valuation and limited margin expansion potential warrant a cautious approach.

Strong Revenue Growth: The Foundation of MACOM's Appeal

MACOM’s recent financial performance has been undeniably positive. Revenue has been steadily climbing, reflecting the increasing adoption of technologies where MACOM’s specialized products play a crucial role. The 5G rollout, in particular, has been a significant tailwind, fueling demand for MACOM’s RF solutions used in base stations and other network infrastructure. Furthermore, the company’s presence in the aerospace & defense market provides a degree of stability and high-value contracts, contributing to consistent revenue streams. The industrial segment, encompassing applications like electric vehicles and power electronics, adds another layer of diversification and growth potential.

The Valuation Question: Is the Market Priced In?

Despite the compelling growth story, MACOM’s valuation remains a significant concern. The stock currently trades at a premium compared to its peers, reflecting high expectations for future performance. While justified to some extent by its leading position in niche markets and robust growth trajectory, the current valuation leaves limited room for error. Any unforeseen headwinds or a slowdown in end markets could disproportionately impact the stock price.

Margin Expansion: A Key Area to Watch

Another factor tempering the upside potential is the relatively constrained margin expansion. While MACOM has shown some improvements in profitability, these have been modest. Factors like rising raw material costs, supply chain challenges, and competitive pricing pressures have put a lid on margin growth. Investors will be closely monitoring MACOM’s ability to improve operational efficiency and leverage its scale to drive greater profitability in the coming quarters. Successfully navigating these challenges will be critical to justifying the current valuation.

Competitive Landscape and Future Outlook

The semiconductor industry is highly competitive, and MACOM faces pressure from both established players and emerging contenders. Maintaining its technological edge and differentiating its products through innovation will be essential for sustained success. Looking ahead, the company's focus on expanding its product portfolio into higher-growth areas, such as silicon carbide (SiC) power devices, could unlock significant new opportunities. However, these ventures also involve risks and require substantial investment.

The Verdict: A Hold Recommendation

MACOM Technology Solutions presents a compelling growth story, underpinned by strong demand in strategic markets. However, the high valuation and limited margin expansion potential suggest that the current price already reflects much of the company’s future prospects. While the long-term outlook remains positive, we believe a “hold” rating is appropriate at this time. Investors who already own MTSI stock should hold onto their shares, while those considering entering the market should await a more attractive valuation.