AI-Powered Investing & Algo Trading Surge: Key Trends Shaping EET 2025

The Future of Trading is Here: AI, Algorithmic Wheels, and TCA Dominate EET 2025

The Electronic Execution & Trading (EET) landscape is undergoing a rapid transformation, driven by the increasing adoption of Artificial Intelligence (AI), sophisticated algorithmic trading strategies, and a renewed focus on Trade Cost Analysis (TCA). Insights gleaned from recent industry reports and discussions point to a significant shift in how buy-side firms are approaching investment analysis and execution, creating both exciting opportunities and critical challenges.

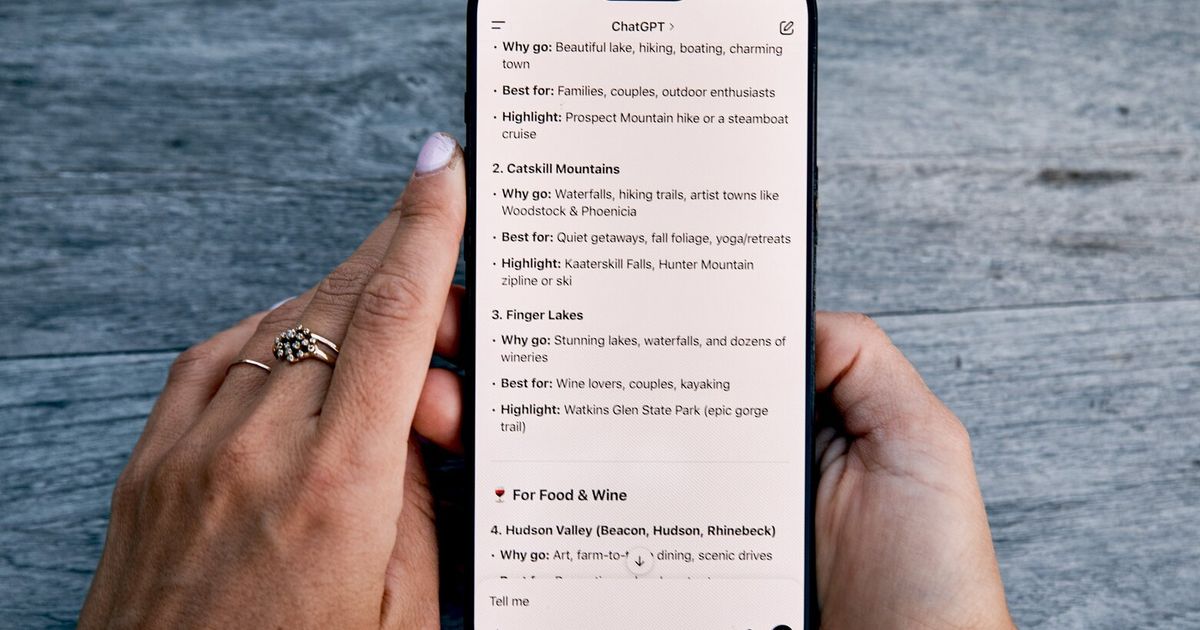

AI Revolutionizing Investment Analysis – But Not Quite Execution (Yet)

One of the most significant trends is the burgeoning use of AI and machine learning within buy-side firms. These technologies are proving invaluable for enhancing investment analysis, uncovering hidden patterns in market data, and improving overall efficiency. AI algorithms are being deployed to sift through vast datasets, identify potential investment opportunities, and refine portfolio construction strategies. However, a critical nuance remains: while AI is significantly impacting the analysis phase, its application to execution decisions is still in its early stages. Firms are understandably cautious about fully automating execution with AI, preferring to retain human oversight for now, particularly in volatile market conditions. This cautious approach reflects a desire to balance the potential benefits of AI with the need for risk management and control.

Algo Wheels Gain Traction in Europe: Optimizing Broker Selection & Performance

Across Europe, a notable shift is underway in how traders are selecting and managing their brokers. The rise of “algo wheels” – dynamic routing systems that automatically rotate orders between multiple brokers based on real-time performance metrics – is gaining considerable traction. This approach allows traders to optimize execution quality, minimize trade costs, and ensure access to the best available liquidity. Algo wheels are not a new concept, but their increasing sophistication and integration with advanced analytics are driving their broader adoption. Traders are now able to leverage data-driven insights to continuously evaluate and refine their broker relationships, leading to improved execution outcomes and greater transparency.

Trade Cost Analysis (TCA): The Unsung Hero of Efficient Trading

Underpinning both AI-powered analysis and algorithmic execution is a renewed emphasis on Trade Cost Analysis (TCA). TCA provides a critical lens through which to evaluate the effectiveness of trading strategies and execution venues. By meticulously analyzing trade costs – including commissions, slippage, and market impact – firms can identify areas for improvement and optimize their trading processes. The increasing regulatory scrutiny surrounding best execution is also driving greater adoption of robust TCA frameworks. Sophisticated TCA tools are now capable of providing granular insights into execution quality, enabling traders to make more informed decisions and demonstrate compliance with regulatory requirements.

Looking Ahead: EET 2025 and Beyond

As we look towards EET 2025 and beyond, the convergence of AI, algorithmic trading, and advanced TCA will continue to shape the industry. We can expect to see:

- Increased adoption of AI in both analysis and, eventually, execution.

- Further refinement of algo wheel strategies and integration with machine learning.

- Greater emphasis on data-driven decision-making across the entire trading lifecycle.

- Enhanced regulatory oversight and a greater focus on transparency and accountability.

The firms that embrace these trends and invest in the necessary technology and expertise will be best positioned to thrive in the evolving EET landscape.