Amkor Technology (AMKR): Navigating Uncertainty – Is This a Hold or a Potential Sell?

Amkor Technology: A Crossroads for Investors

Amkor Technology (AMKR) has demonstrated resilience, bouncing back from a significant downturn. However, the semiconductor industry remains fraught with challenges, and shifting demand patterns pose a potential threat to further gains. This analysis delves into Amkor's current position, evaluating the factors supporting its hold rating while also exploring the risks that could lead to another decline. We'll examine market trends, Amkor’s strategic positioning, and potential catalysts to help investors make informed decisions.

The Recent Rebound: A Look at the Recovery

After experiencing a considerable drop, Amkor Technology has shown signs of recovery, a positive indicator in a volatile market. This rebound can be attributed to a few key factors. Firstly, the easing of supply chain constraints has allowed Amkor to better fulfill orders and improve operational efficiency. Secondly, certain segments of the semiconductor market, particularly those related to automotive and industrial applications, have shown surprising strength, offsetting some of the weakness in consumer electronics. Finally, Amkor's focus on advanced packaging technologies, crucial for modern chip design, has positioned it favorably within the industry.

Headwinds and Uncertainties: The Challenges Ahead

Despite the recent positive momentum, Amkor faces significant headwinds. The global macroeconomic environment remains uncertain, with concerns about inflation, interest rate hikes, and potential recessionary pressures. These factors could dampen overall demand for electronics, impacting Amkor's revenue. Furthermore, the semiconductor industry is notoriously cyclical, and the current cycle appears to be transitioning towards a period of slower growth. Demand for smartphones and personal computers, historically major drivers of semiconductor sales, has softened, and this trend is expected to continue.

Amkor's Strategic Positioning: Advanced Packaging as a Differentiator

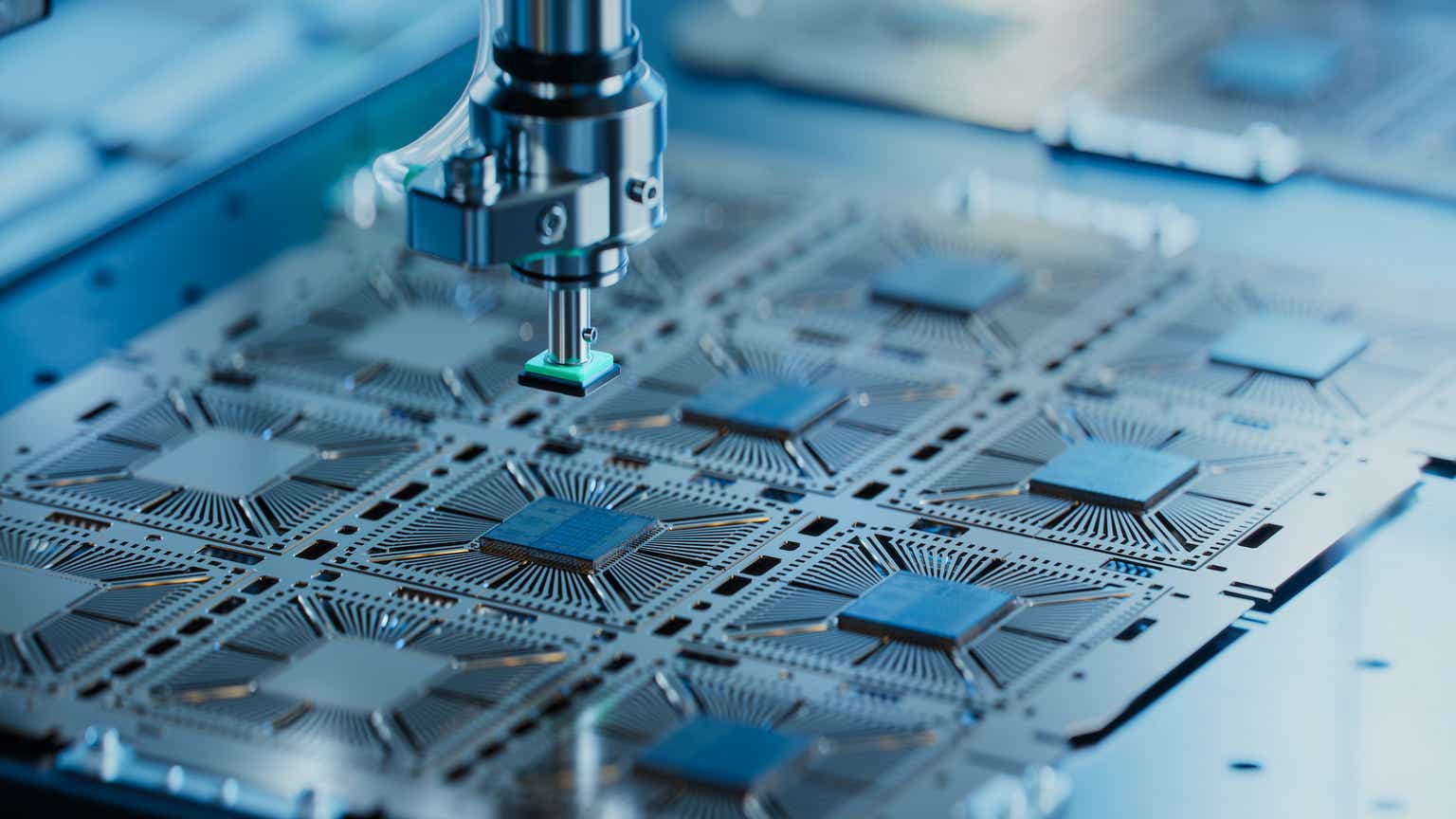

Amkor’s strength lies in its focus on advanced packaging technologies. As chip designs become increasingly complex, advanced packaging is becoming essential for optimizing performance and reducing costs. Amkor is a leading player in this space, offering a wide range of packaging solutions for various applications. This strategic focus provides a degree of insulation from the cyclical downturns affecting other parts of the semiconductor industry. However, competition in the advanced packaging market is intensifying, and Amkor needs to continue innovating to maintain its competitive edge.

Key Considerations for Investors

- Macroeconomic Outlook: Closely monitor global economic indicators and their potential impact on electronics demand.

- Semiconductor Cycle: Be aware of the cyclical nature of the semiconductor industry and anticipate potential shifts in demand.

- Competition: Assess the competitive landscape in advanced packaging and Amkor’s ability to maintain its market share.

- Technological Innovation: Track Amkor’s investment in research and development and its ability to deliver innovative packaging solutions.

- Financial Performance: Analyze Amkor’s revenue growth, profitability, and cash flow to evaluate its financial health.

The Verdict: A Cautious Hold

While Amkor Technology has demonstrated resilience and possesses a strong strategic position in advanced packaging, the uncertainties surrounding the global economy and the semiconductor industry warrant a cautious approach. The recent rebound is encouraging, but the potential for another decline remains. Therefore, we maintain a hold rating on AMKR stock. Investors should carefully monitor the factors outlined above and reassess their positions as new information becomes available. A shift in macroeconomic conditions or a significant change in Amkor’s competitive landscape could warrant a change in rating.