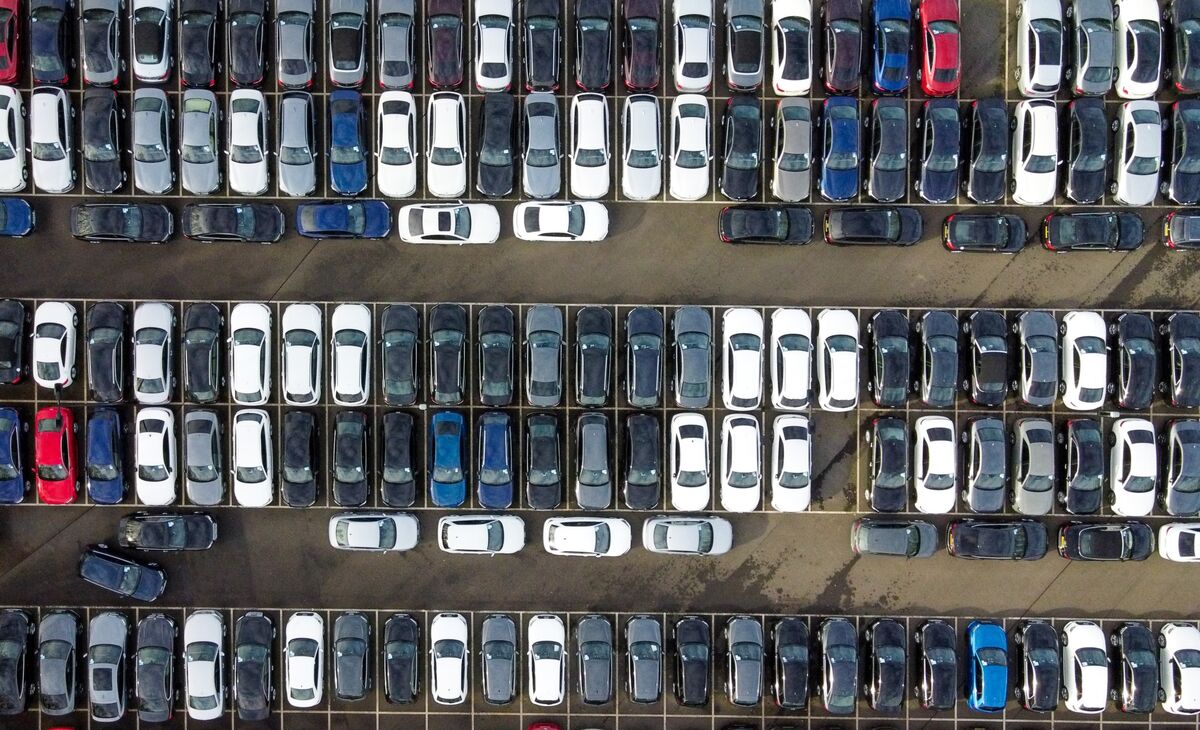

Massive Motor Finance Compensation: UK's FCA Plans £9-£18 Billion Redress Scheme

London, UK – In a landmark move following a recent Supreme Court ruling, the UK's Financial Conduct Authority (FCA) has unveiled a proposed redress scheme for consumers who believe they were mis-sold motor finance agreements. The potential cost of this scheme is staggering, estimated to range between £9 billion and £18 billion – a sum that could significantly impact lenders and reshape the motor finance landscape.

The Supreme Court Ruling: A Catalyst for Change

The FCA's proposal stems from a landmark Supreme Court ruling last week. The ruling centered on whether lenders were required to consider a consumer's ability to repay a loan when offering motor finance. The court determined that lenders should have considered this factor, potentially leading to widespread claims of mis-selling.

What Does This Mean for Consumers?

Millions of UK consumers who took out motor finance agreements between April 2008 and the present could be eligible for compensation. The FCA’s redress scheme aims to provide a streamlined and efficient process for these claims to be assessed and resolved. The amount of compensation individuals may receive will depend on the specifics of their loan agreement and how the lender handled their application.

The Scale of the Problem: A £9-£18 Billion Bill

The FCA’s estimate of £9 billion to £18 billion is a significant figure, highlighting the potential scale of the problem. This cost reflects the number of affected consumers, the complexity of the claims, and the potential for significant payouts. Lenders are now grappling with the implications of this announcement and are preparing for a surge in claims.

How the Redress Scheme Will Work

The FCA is proposing a voluntary redress scheme where lenders will proactively contact consumers who may be eligible for compensation. Consumers will then have the opportunity to submit a claim. The FCA will oversee the scheme to ensure fairness and transparency. A detailed timetable for the scheme’s implementation is expected to be announced shortly.

Industry Reaction and Future Implications

The announcement has sent ripples through the financial industry. Lenders are assessing their exposure and working to understand the full implications of the Supreme Court ruling. Analysts predict that this case could lead to increased scrutiny of lending practices and a greater emphasis on responsible lending.

Looking Ahead: Key Considerations

- Eligibility: Consumers who took out motor finance agreements between April 2008 and the present may be eligible.

- Claims Process: Lenders will proactively contact potential claimants, and a formal claims process will be established.

- Compensation Amount: The amount of compensation will vary based on individual circumstances.

- Scheme Timeline: A detailed timetable for the scheme’s implementation will be released by the FCA.

This redress scheme represents a pivotal moment for consumers and the motor finance industry in the UK. As the scheme progresses, it will be crucial for both lenders and consumers to understand their rights and responsibilities to ensure a fair and efficient resolution process. Stay tuned for further updates on this developing story.