Portman Ridge Finance Merger: A Risky Bet for Investors?

The announcement of a merger between Portman Ridge Finance and Logan Ridge Finance (LRFC) has sent ripples through the financial sector. While the promise of synergies and increased efficiency often accompanies such combinations, a closer look at Portman Ridge Finance (PTMN) reveals potential pitfalls that warrant caution for investors. This article delves into the details of the merger, explores the underlying risks, and offers a perspective on whether PTMN stock is a worthwhile investment.

The Merger: A Strategic Move or a Red Flag?

The proposed merger aims to create a larger, more diversified finance company, leveraging the strengths of both Portman Ridge and Logan Ridge. Proponents argue that the combined entity will benefit from economies of scale, expanded product offerings, and a broader investor base. The synergy potential is undoubtedly attractive on paper. However, the devil is always in the details, and a thorough examination of the financial health and operational track records of both companies is crucial.

Why Caution is Advised: Unpacking the Risks

Several factors contribute to the need for investor caution regarding PTMN stock following this merger announcement. Firstly, both Portman Ridge and Logan Ridge have faced challenges in recent years, including fluctuating interest rates and evolving regulatory landscapes. Integrating two companies with existing operational complexities can be fraught with difficulty, potentially leading to unforeseen costs and delays.

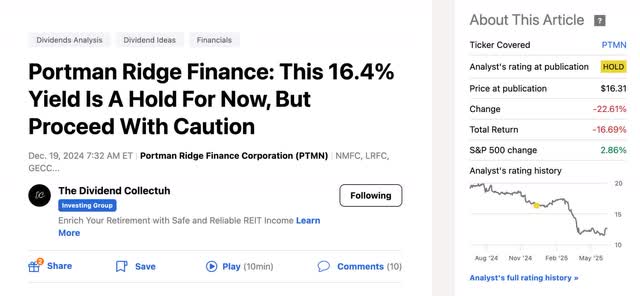

Secondly, the market's reaction to the merger announcement has been mixed, suggesting underlying concerns among seasoned investors. A careful analysis of trading volume, price volatility, and analyst ratings is essential to gauge the overall sentiment surrounding PTMN.

Thirdly, the specific terms of the merger agreement, including the exchange ratio and potential shareholder dilution, need to be scrutinized. A seemingly advantageous deal can quickly turn sour if the terms are unfavorable to existing PTMN shareholders. Understanding the motivations of both management teams and any potential conflicts of interest is also paramount.

Diving Deeper: Financial Health and Key Metrics

A comprehensive assessment of PTMN's financial health requires examining key metrics such as revenue growth, profitability margins, debt levels, and asset quality. While the merger is intended to improve these metrics, it's essential to consider the potential impact of integration costs and any unforeseen challenges that may arise. Comparing PTMN's performance to its peers in the finance industry provides valuable context and allows investors to benchmark its relative strengths and weaknesses.

The Bottom Line: Proceed with Prudence

The merger between Portman Ridge Finance and Logan Ridge Finance presents both opportunities and risks. While the potential for synergies is appealing, investors should not be swayed by the hype. A cautious and analytical approach is warranted, carefully weighing the potential benefits against the inherent risks. Thorough due diligence, a deep understanding of the financial intricacies, and a realistic assessment of the integration challenges are essential before making any investment decisions regarding PTMN stock.

Ultimately, two wrongs don't make a right. A merger born out of necessity or a desire to mask underlying problems is unlikely to create lasting value for shareholders. Investors should prioritize companies with a proven track record of success, sound financial management, and a clear strategic vision.