Navigating Financial Anxiety: Practical Strategies for Uncertain Times

The economic landscape feels unpredictable for many Americans. Rising costs, inflation, and concerns about job security are fueling widespread financial anxiety. But you don't have to feel helpless. Building your 'financial efficacy' – your ability to manage and navigate financial challenges – is key to reducing stress and regaining control. This guide provides practical, actionable strategies to help you weather the storm and build a more secure financial future.

Understanding the Roots of Financial Stress

Before diving into solutions, it's crucial to acknowledge the source of your stress. Is it related to debt, job instability, unexpected expenses, or simply the fear of the unknown? Identifying the specific triggers allows you to tailor your approach.

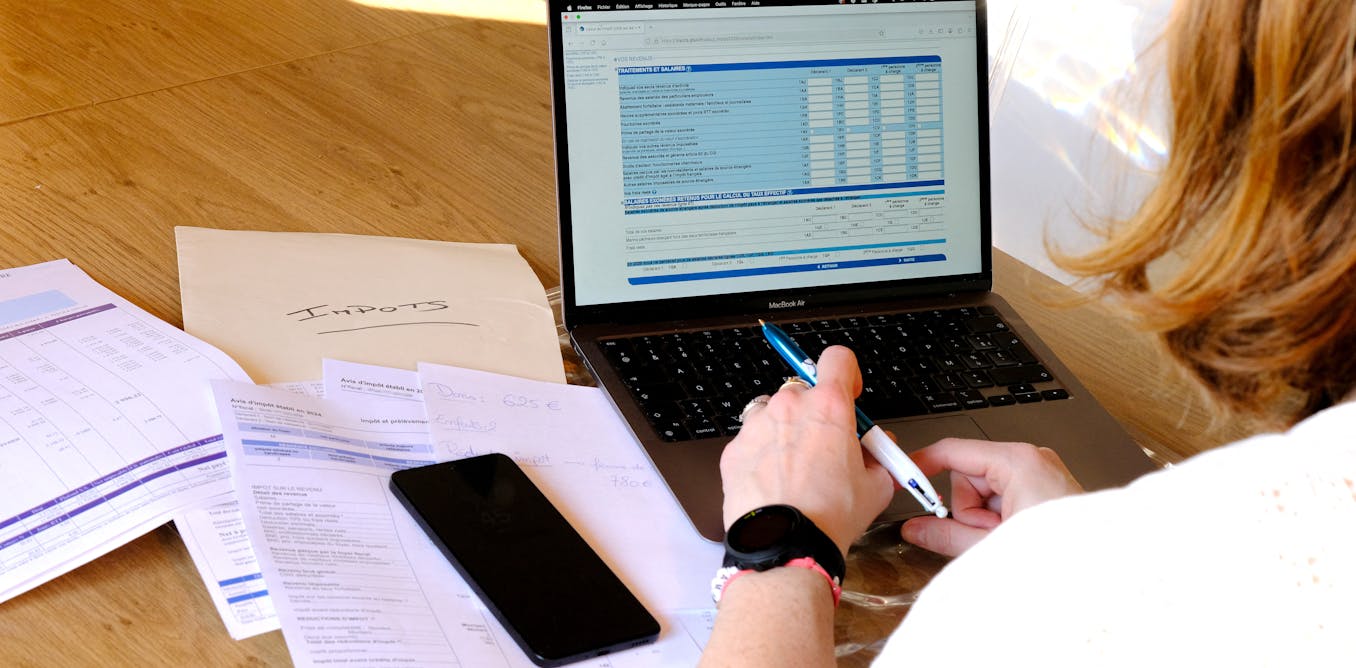

1. Assess Your Current Financial Situation

The foundation of financial management is a clear understanding of where you stand. Start by creating a detailed budget. Track your income and expenses for a month or two to identify areas where you can cut back. Use budgeting apps or spreadsheets to simplify the process.

- Income: List all sources of income (salary, investments, side hustles).

- Expenses: Categorize expenses into fixed (rent/mortgage, utilities) and variable (groceries, entertainment).

- Debt: Compile a list of all debts, including balances, interest rates, and minimum payments.

2. Build an Emergency Fund

An emergency fund is your financial safety net. Aim to save 3-6 months' worth of living expenses in a readily accessible account. Even small, consistent contributions can make a difference. Start with a goal of $1,000, then gradually increase it.

3. Tackle Debt Strategically

High-interest debt, like credit card balances, can be a major source of stress. Consider these strategies:

- Debt Avalanche: Pay off the debt with the highest interest rate first.

- Debt Snowball: Pay off the smallest debt first for quick wins and motivation.

- Balance Transfer: Explore transferring high-interest balances to a card with a lower interest rate.

4. Review Your Spending Habits

Once you have a budget, analyze your spending patterns. Are there areas where you can realistically cut back without sacrificing your quality of life? Consider:

- Subscriptions: Cancel unused subscriptions.

- Dining Out: Reduce the frequency of eating out.

- Entertainment: Explore free or low-cost entertainment options.

5. Seek Professional Guidance

If you're feeling overwhelmed, don't hesitate to seek help from a financial advisor or credit counselor. They can provide personalized advice and support to help you achieve your financial goals.

6. Stay Informed and Adapt

The economic landscape is constantly evolving. Stay informed about market trends and adjust your financial plan accordingly. Be prepared to adapt to changing circumstances and remain flexible in your approach.

Conclusion

Managing financial stress in uncertain times requires proactive planning, disciplined spending, and a commitment to building a more secure financial future. By implementing these strategies, you can reduce anxiety, regain control, and navigate the challenges with confidence. Remember, small steps taken consistently can lead to significant progress over time. Don't wait—start building your financial efficacy today!