Maine Residents Brace for Sticker Shock: Health Insurance Rates Poised for Significant Increase

Maine residents are facing a tough reality: their health insurance premiums are about to jump significantly. A combination of factors, primarily the escalating cost of prescription drugs and a lack of robust competition within the state's insurance market, is driving this unwelcome trend. This article delves into the specifics of these challenges, explores the potential impact on Maine families, and examines possible solutions to mitigate the financial burden.

The Prescription Drug Price Surge

One of the most significant contributors to rising health insurance costs nationwide, and particularly acute in Maine, is the relentless increase in prescription drug prices. Pharmaceutical companies have been consistently raising prices on both brand-name and generic medications, placing immense pressure on insurers. These higher drug costs are then passed on to consumers in the form of increased premiums. Maine, like many states, struggles to effectively regulate drug prices, leaving residents vulnerable to these inflationary pressures.

“We’re seeing a concerning trend where the cost of essential medications is outpacing wage growth, making it increasingly difficult for Maine families to afford their healthcare,” explains Sarah Miller, a healthcare policy analyst at the Maine Center for Public Policy. “The lack of transparency in drug pricing and the limited negotiating power of insurers are key factors contributing to this problem.”

Limited Competition: A Key Weakness

Beyond the drug price issue, Maine's relatively small and concentrated insurance market exacerbates the problem. With fewer insurance providers competing for customers, there’s less incentive to offer competitive rates. This lack of competition allows existing insurers to raise prices without fear of losing significant market share. The limited choice also restricts consumers' ability to shop around for more affordable options.

“Maine’s insurance market isn’t as dynamic as we’d like it to be,” says John Thompson, a consumer advocate for Maine Consumers for Affordable Healthcare. “We need to encourage more insurers to enter the market and foster a more competitive environment to drive down costs.”

Impact on Maine Families

The projected rate increases will disproportionately impact lower- and middle-income families in Maine. Higher premiums mean less disposable income for other essential needs, such as food, housing, and education. For those with pre-existing conditions, the rising costs can be particularly devastating, potentially leading to delayed or forgone care.

Potential Solutions and What's Next

Addressing this complex issue will require a multi-faceted approach. Possible solutions include:

- Drug Price Negotiation: Empowering the state to negotiate directly with drug manufacturers to secure lower prices.

- Increased Competition: Implementing policies that encourage new insurance providers to enter the Maine market.

- Transparency in Pricing: Requiring insurers and pharmaceutical companies to be more transparent about how prices are set.

- Subsidies and Financial Assistance: Expanding access to subsidies and financial assistance programs for low-income families.

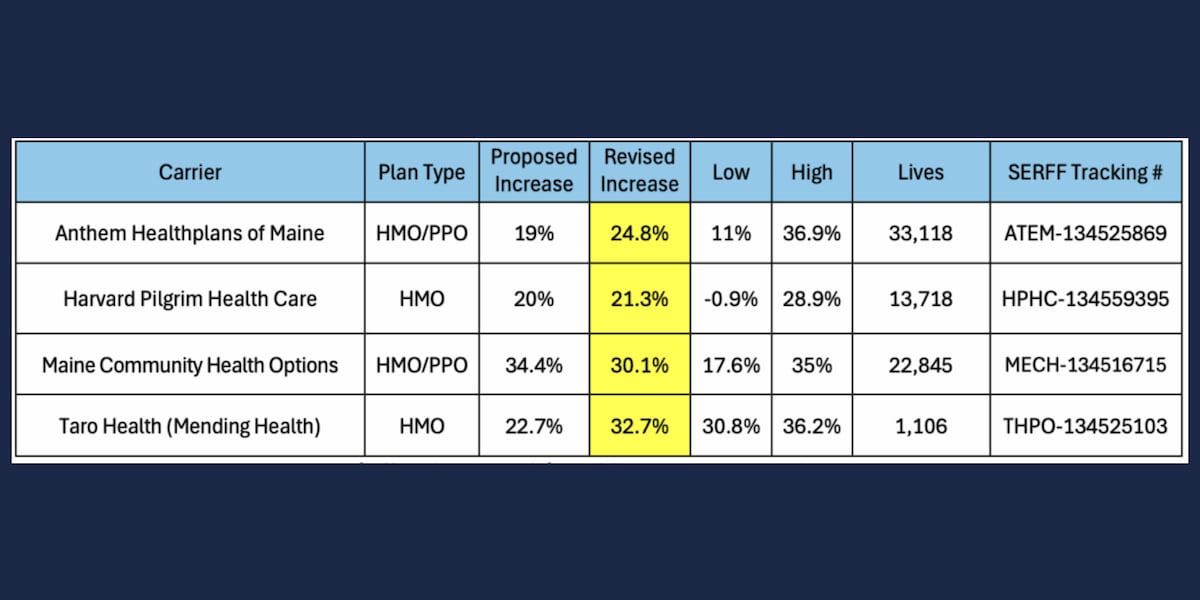

Maine’s insurance regulators are currently reviewing the proposed rate increases and will hold public hearings to gather feedback from residents and stakeholders. The coming months will be crucial in determining the extent of the impact on Maine families and the measures that will be taken to address this growing affordability crisis. Stay tuned for further updates and analysis on this developing story.