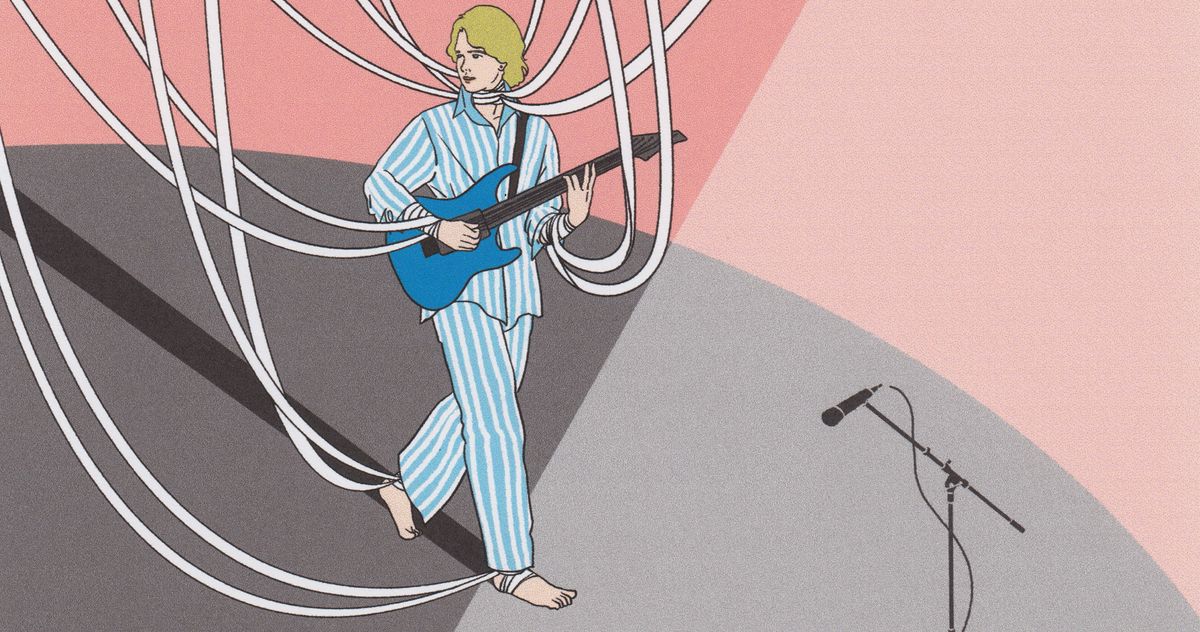

Struggling to Stay in Tune: Aussie Musicians Share Their Health Insurance Nightmares

The music industry is known for its passion, creativity, and… surprisingly, a whole lot of stress when it comes to health insurance. Just like countless Australians, many musicians find themselves battling confusing policies, sky-high premiums, and frustrating claim denials. We’ve spoken to several Aussie musicians who’ve experienced the health insurance horror show firsthand, revealing the challenges they face in accessing vital healthcare while pursuing their musical dreams.

The Rising Costs & Complexities

Like Sadie Dupuis, the singer and guitarist for indie-rock outfit Speedy Ortiz (whose experiences resonate with many across the globe), many musicians are finding the cost of health insurance increasingly unsustainable. The average monthly premium for a comprehensive health insurance policy in Australia is steadily climbing, often exceeding $600. For musicians, particularly those who are self-employed or gigging, this can represent a significant portion of their income. Coupled with the complexities of navigating different policy types, waiting periods, and exclusions, it’s a recipe for frustration and anxiety.

“It’s a constant worry,” says local singer-songwriter, Eliza Bloom. “I’m constantly weighing up whether to see a specialist or put it off. The premiums are already high, and then you have to factor in the potential out-of-pocket expenses. It’s really tough when you’re juggling multiple gigs and trying to make ends meet.”

Navigating the ACA and Private Insurance

Many musicians rely on the Affordable Care Act (ACA) or private insurance options. However, these systems aren't always straightforward. The ACA, while providing subsidies for some, can still be complex to understand and navigate. Private insurance, while offering more flexibility, often comes with higher premiums and potentially limited coverage.

Guitarist and producer, Liam Carter, shares his experience: “I spent weeks trying to decipher the fine print of my private health insurance policy. I thought I was covered for physiotherapy, but when I actually needed it, I was hit with a huge bill. It felt like I was being penalised for needing healthcare.”

The Impact on Wellbeing & Performance

The stress of dealing with health insurance issues can take a significant toll on musicians’ wellbeing and, ultimately, their performance. The anxiety of potential medical bills can distract from their creative work and impact their mental health. Furthermore, the lack of access to timely and affordable healthcare can lead to chronic health issues going unaddressed, further impacting their ability to perform and tour.

“It’s not just about the money,” explains drummer, Maya Singh. “It’s about the peace of mind. Knowing you can access healthcare when you need it allows you to focus on your music and your wellbeing. When you’re constantly worried about medical bills, it’s hard to be creative and perform at your best.”

What Can Be Done?

The stories of these musicians highlight the urgent need for reform in the Australian healthcare system. Increased transparency in insurance policies, subsidies for self-employed individuals, and greater support for the arts community are all crucial steps. Musicians and other self-employed individuals need access to affordable and comprehensive healthcare to thrive both personally and professionally.

Ultimately, ensuring access to quality healthcare shouldn't be a luxury, but a right, for all Australians, including those who enrich our lives through music.